If you sell digital goods to customers based in the EU using the Easy Digital Downloads plugin, you’ll need a way to collect, process, and store EU VAT – regardless of whether your company is based in the EU or not. The easiest way to do this is by using the Easy Digital Downloads EU VAT plugin.

It automatically charges customers the correct VAT, removes VAT for registered EU businesses, and keeps a record of the customer’s IP address to help you comply with EU VAT rules and regulations.

In this article, we’ll walk you through a step-by-step tutorial to show you how you can ensure your Easy Digital Downloads store is compliant with EU tax laws. But first, let’s take a quick look at what the EU VAT law is and who is required to comply with it.

What You Need to Know About the EU VAT Law

EU VAT (aka European Union value added tax, or IVA in some countries) is a tax that’s added to products and services that are sold in EU member states. It’s charged to the end customer when they make a purchase. The seller is required to collect the tax and pay it to the correct tax authorities.

Before January 1st 2015, the law stated that if a business sells digital products to a customer residing in an EU member state then the place of supply was the country the seller was based in and not the end customer.

However, the law was last updated on January 1st, 2015 and now states that if a business sells digital products to a customer residing in an EU member state then the place of supply is where the consumer is based and not the seller.

As a result of the updated legislation, companies selling digital products to customers based in the EU must collect and handle the VAT at the customer’s local rate.

Here’s a quick example:

If your company is based in the United States of America and sells digital goods to a customer in France, you’ll have to charge French VAT to that customer and pay it to the tax authorities in France.

Are You Required to Comply With EU VAT Law?

If your Easy Digital Downloads store sells to customers based in the EU member states, you must charge them EU VAT given that your combined annual revenue from all EU countries is more than €10,000.

The only condition for not charging VAT to EU consumers is when you have collected evidence that they are a registered company. Practically speaking, what this means is that you need to be able to check to see if the customer is actually a registered business and decide whether or not to charge VAT accordingly. The time to do this is at the checkout page once the customer provides their billing address.

Now that you know what the EU VAT law is and who’s required to comply with it, let’s take a closer look at the Easy Digital Downloads EU VAT plugin and how it helps you stay on top of things.

Introducing the Easy Digital Downloads EU VAT Plugin

The Easy Digital Downloads EU VAT plugin by Barn2 Media works seamlessly with any WordPress website that uses the Easy Digital Downloads plugin to sell digital goods. It makes use of EDD’s built-in features to create a complete EU VAT solution.

Here’s a quick breakdown of how it works:

- Charges EU-based consumers the correct VAT. When the customer selects their country on the Easy Digital Downloads checkout page, the EDD EU VAT plugin automatically adds the relevant VAT to their total bill. This way, customers can be sure that they’re always charged the correct VAT rate regardless of where they’re based.

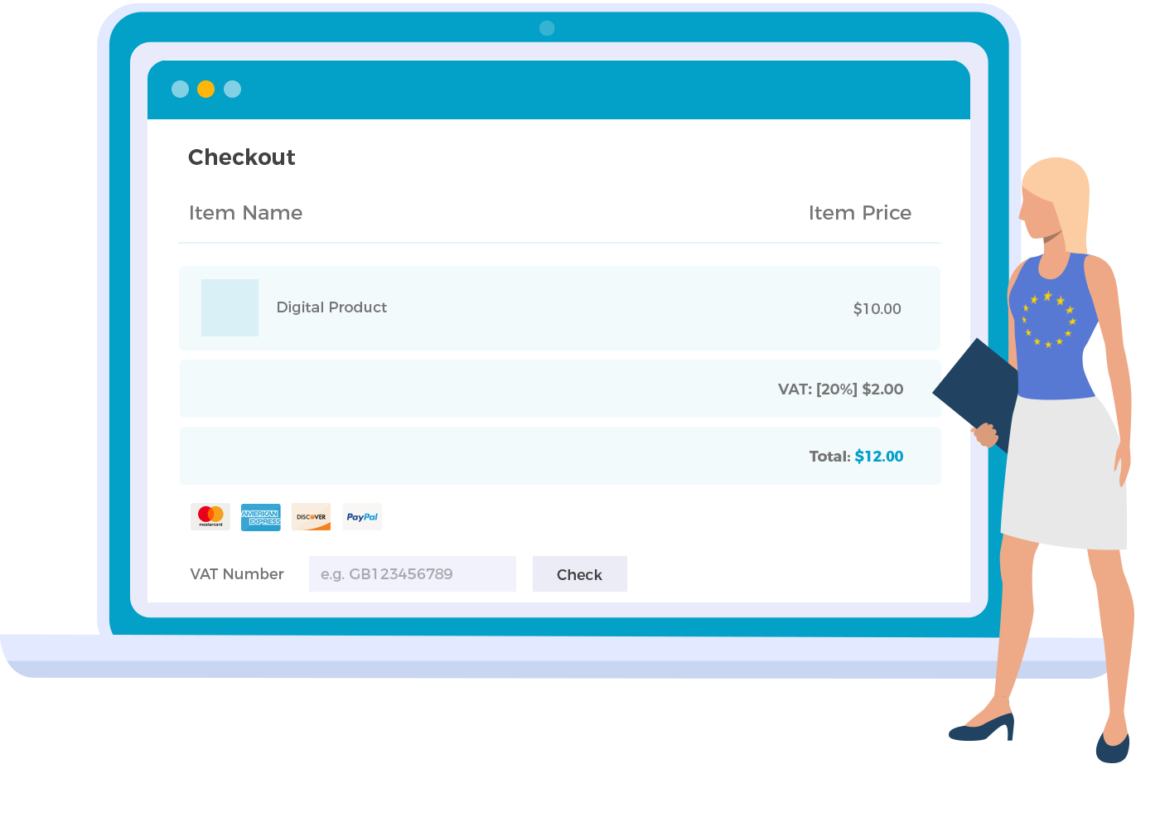

- Checks to see if the consumer is a registered EU company. The EDD EU VAT plugin creates a VAT number field on the Easy Digital Downloads checkout page. This gives VAT-registered EU businesses the option to enter their VAT number. The number is cross-checked against the official VAT register and, if it’s correct, no VAT is charged on the sale. That’s important because B2B transactions aren’t subject to EU VAT.

- Collates evidence needed for EU VAT compliance. The plugin stores two pieces of evidence of the customer’s location (their billing and IP address) and displays this in a handy box on the Easy Digital Downloads payment record. This makes it easy for you to check how VAT has been calculated.

- Converts Easy Digital Downloads receipts into valid tax invoices. As soon as you install the plugin, the EDD payment details screen is extended to become a full EU tax invoice. It also integrates with PDF Invoices (if you are using that extension), and comes with merge tags so that you can add EU VAT information to your email receipts.

- Generate quick EU VAT reports for tax returns. The plugin has a handy reporting feature where you can instantly generate an export file containing all the information you need for your quarterly MOSS tax returns.

What’s more, is that the EDD EU VAT plugin provides extensive documentation to help store owners better manage EU VAT. It does this by explaining how store owners can:

- Provide additional legally valid VAT receipts and invoices to consumers.

- Export the legally required proof about each customer’s location, for example in case you are ever audited.

In addition to all of this, the EDD EU VAT plugin also provides actionable advice and best practices for how EDD store owners can make sure their company complies with the EU VAT law.

How to Make Your EDD Store EU VAT-Compliant (In 4 Easy Steps)

Now that we know what the EU VAT law is and how the Easy Digital Downloads EU VAT plugin can help you stay on top of it, let’s dive right in and see how you can ensure compliance with the EU VAT.

Step #1: Register With a Tax Authority in the EU

The first thing you need to do is register with a tax authority in the EU since you’ll be collecting EU VAT from customers based in EU member states. Instead of registering for VAT in each EU country you sell digital goods, you can register for Mini-One-Stop-Shop (MOSS). The key benefit of registering for MOSS is that it’s free and you won’t have to spend a lot of time filing paperwork for each EU country you sell digital products in.

For those unfamiliar, VAT MOSS is a way of submitting a quarterly single tax return by making a single payment that covers all EU countries. In simple words, all of the EU VAT you collect will be declared in your online tax returns and you’ll only have to make a single payment. It will then be distributed to the relevant EU countries by the MOSS service on your behalf.

Step #2: Set Up the EDD EU VAT Plugin on Your Website

Since each EU member state is free to determine its own VAT rate, your EU VAT-compliant EDD store should be able to automatically charge the correct tax rate to customers depending on which EU member state they’re based in.

This is where the Easy Digital Downloads EU VAT plugin can make things incredibly easy for you. It allows you to charge the correct standard VAT rate for each EU member state, automatically.

All you have to do is install the plugin to your online store and customers will be charged the current standard VAT rate depending on the country they’re based in.

While the EDD EU VAT plugin comes pre-programmed with the standard VAT rate for each EU country, it also gives you the option to modify these tax rates. You can do this by navigating to the general Easy Digital Downloads settings from Downloads > Settings > Taxes. In this way, the EDD EU VAT plugin allows you to be completely flexible with your tax rates, as well as charge VAT for non-EU countries.

The EDD EU VAT plugin integrates with the payment receipt that’s generated by Easy Digital Downloads and its PDF Invoice plugin. You can use this feature to provide EU customers with VAT receipts that they can use for tax and accounting purposes in three different ways:

- Declaring EU VAT in the Easy Digital Downloads payment receipt email.

- Letting customers access the tax information for their ordered products via the customer account page.

- Attaching a PDF invoice to the Easy Digital Downloads order confirmation email (requires the official EDD PDF Invoices extension).

Step #3: Storing Proof of Your Customers’ Location

As the store owner, you need to collect two pieces of evidence to confirm which EU member state each of your customers is based in and store this information for a period of 10 years.

The EDD EU VAT plugin displays this evidence in an easy-to-find format on the Easy Digital Download payment screen so that you can access it at any time. You can view the customer’s VAT number (for reverse charged B2B transactions), along with their billing address, country and IP address.

Since this evidence is collected by Easy Digital Downloads and the EDD EU VAT plugin, it will be available to you as long as your store stays online – unlike some SAAS VAT services where you lose the evidence if you ever cancel your subscription with them. You can export the evidence whenever you need, for example if you are ever audited.

Step #4: Sending Quarterly EU VAT Returns

Easy Digital Downloads store owners can easily generate the information for their quarterly MOSS VAT returns by exporting the tax information from EDD.

To download all the payment records for the time period you want to report on, navigate to Downloads > Reports > Export from the WordPress admin and use the Export EU VAT tool. You can open this file using spreadsheet software such as Microsoft Excel or Google Sheets. It contains all the data you need for your quarterly MOSS tax returns.

Be sure to check out the EU VAT for Easy Digital Downloads: Complete Guide for an in-depth explanation of the EU VAT law and how to use the EDD EU VAT plugin on your online store.

Conclusion

Understanding and complying with the EU VAT law can be tricky – especially for first-time store owners. The good news is that you can use the Easy Digital Downloads EU VAT plugin to:

- Collect, process, and store EU VAT without disrupting the end-user experience your store delivers.

- Check to see if the consumer is a registered EU company and decide whether or not to charge them VAT.

- Compile all the customer location evidence you need for EU VAT compliance.

- Generate reports containing everything you need for your quarterly tax return.

While no one wants to think about VAT, if you sell digital products to customers in the EU then this is a legal requirement for your business. As a result, this affects nearly all Easy Digital Downloads stores worldwide.

Now you know how you can make sure that your EDD store is compliant with the EU VAT law using the Easy Digital Downloads EU VAT plugin. Hopefully, you’re in a good position now to take the next steps.

Do you have any questions about the EU VAT law or how to comply with it as an EDD store owner? Let us know by dropping a comment below!

About Maria

From C++ to PHP, the language Maria thinks in is code, and translates it to English for humans to understand. She has a degree in Computer Science and is the writer of choice for many organizations. She is also The Big Boss at BloggInc., calling all the shots and personally supervising every word and piece of content.

Related Articles

-

During the past few months we’ve been hard at work on developing an extension for Easy Digital Downloads that will allow you to create bookable products and services. We’re finally…

-

From January 1, 2015, the European Union has put into effect the new rules about the taxation on the purchase of digital goods (software, electronic, e-book, telecommunications and broadcast services)…

-

For many WordPress business owners, such as plugin and theme sellers, the big news this week was the release of a new version of Recurring Payments for Easy Digital Downloads.…

-

Easy Digital Downloads now has the ability to display recommended products for your customers before they check out. This has the ability to increase your sales by up to 31%,…

Keep reading the article at WP Mayor. The article was originally written by Maria on 2020-02-05 06:00:00.

The article was hand-picked and curated for you by the Editorial Team of WP Archives.